You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ready to lease in Northern Ca

- Thread starter Lynn

- Start date

Help Support Ford Focus Electric Forum:

This site may earn a commission from merchant affiliate

links, including eBay, Amazon, and others.

michael

Well-known member

I think should be around $300 including tax, zero driveaway.

Can recommend socal dealer, don't know about nocal

Can recommend socal dealer, don't know about nocal

Lynn said:I am ready to take the plunge. Interested in a 12k/36 months lease with 0 down. I live in San Jose, CA. Does anyone have suggestions of dealerships and ballpark prices? Thanks.

I got my FFE at Capital Expressway Ford just 10 days ago. My deal is 2000 down, 225 monthly payment (tax included) for a 36/36000 lease. The other dealership (Fremont Ford) could offer me 2000 down + 217 monthly, but I was just too lazy to drive 20 more miles for that 8$ difference. Since the interest rate is very low, converting to 0 down, the monthly payment should be around 282$.

Kakkerlak

Well-known member

Laixl,

Do you know if the CARB rebates are back in action ? This spring (after March 28, 2014), they had run out and were putting ZEV buyers onto a waiting list to receive their rebates in September 2014. As far as I've read, that's still the case. My guess is that Ford Motor Credit gets that rebate since they're really the buyer, so they probably have a good idea of when and whether that money will be available.

Can you tell us what the residual percentage you were given for the 36/36000 lease was ? I was offered 42% residual on a 36/36000 lease last week in Washington State.

Did the dealer require that down-payment, or did you pay it up front to lower your monthly payment ?

Do you know if the CARB rebates are back in action ? This spring (after March 28, 2014), they had run out and were putting ZEV buyers onto a waiting list to receive their rebates in September 2014. As far as I've read, that's still the case. My guess is that Ford Motor Credit gets that rebate since they're really the buyer, so they probably have a good idea of when and whether that money will be available.

Can you tell us what the residual percentage you were given for the 36/36000 lease was ? I was offered 42% residual on a 36/36000 lease last week in Washington State.

Did the dealer require that down-payment, or did you pay it up front to lower your monthly payment ?

The Federal rebate goes to Ford, but you can still get the state rebate. In CA, I will get 2500$ back.

My residual value is 15xxx, don't remember the exact number. I think down payment doesn't matter, I put 2000 because I need to spend couple thousands for my new credit card.

My residual value is 15xxx, don't remember the exact number. I think down payment doesn't matter, I put 2000 because I need to spend couple thousands for my new credit card.

Kakkerlak said:Laixl,

Do you know if the CARB rebates are back in action ? This spring (after March 28, 2014), they had run out and were putting ZEV buyers onto a waiting list to receive their rebates in September 2014. As far as I've read, that's still the case. My guess is that Ford Motor Credit gets that rebate since they're really the buyer, so they probably have a good idea of when and whether that money will be available.

Can you tell us what the residual percentage you were given for the 36/36000 lease was ? I was offered 42% residual on a 36/36000 lease last week in Washington State.

Did the dealer require that down-payment, or did you pay it up front to lower your monthly payment ?

v_traveller

Well-known member

Per CVRP, reservations for the rebates are being taken, checks to be mailed in September. Gotta wait for the next fiscal year to start for new funding to become available, I presume.

https://energycenter.org/clean-vehicle-rebate-project

https://energycenter.org/clean-vehicle-rebate-project

$42.99

$49.99

Hi-Spec Tools 67pc SAE Auto Mechanics Hand Tool Kit Set. Complete Car, Motorcycle, Engine & Garage Repairs with Sockets, Ratchet Wrench, Pliers & More

Hi-Spec Products, Inc.

$59.99

$79.99

WORKPRO 12V Cordless Drill Driver and Home Tool Kit, Hand Tool Set for DIY, Home Maintenance, 14-inch Storage Bag Included

GreatStar Tools

WattsUp

Well-known member

It's not a rebate, it's a tax credit.laixl said:The Federal rebate goes to Ford

But, you are correct, when you lease, Ford gets to claim the federal credit, not you. But, when you purchase, you get to claim it. However, your total tax liability (for the tax year in which you purchased the EV) must be $7500 or higher in order to be eligible to receive the entire credit. In other words, the credit only applies towards "owed" taxes, nothing else (that's why it is called a tax credit). If you owe less than $7500, then you will only be eligible for a partial credit.

TexaCali

Well-known member

Hi Lynn,

I'm also in San Jose. As you know, there are several Ford dealers in the area. It just so happens we wound up buying a car from Walnut Creek Ford a year ago because they were the only dealer in the area that had what my wife wanted (AWD Fusion in Black). We dealt with Sherri in the "internet department" and had such a positive experience that when it came time to get my FFE I just called her up. I told her what I wanted and she quoted me a great out the door price and had the color/options I wanted, so I said "let's do it". She told me to fill our their on line credit app (took about 2-3 min) and come pick it up that same day. When I got there the paperwork was ready, the car was prepped, and all I had to do was sign and drive off. Of course I wound up spending a bit longer, chit chatting, getting the tour of the car, etc.

I purchased mine (getting the $7500 tax credit and 0% financing was just too tempting), so I can't tell you what the lease deal would have been. I'm sure there are other sales people that are just as good to work with and the deals are probably very similar, but I'll certainly call Sherri at Walnut creek next time I'm in the market for a new Ford. The drive isn't that far and in my opinion adds to the fun.

Best of luck and let us know how it turns out.

BTW - several of us will be meeting Saturday morning for a drive up Mt Hamilton (see http://www.myfocuselectric.com/forum/viewtopic.php?f=14&t=2027). Feel free to come by and say high, and by all means if you get your car by then, join the fun.

I'm also in San Jose. As you know, there are several Ford dealers in the area. It just so happens we wound up buying a car from Walnut Creek Ford a year ago because they were the only dealer in the area that had what my wife wanted (AWD Fusion in Black). We dealt with Sherri in the "internet department" and had such a positive experience that when it came time to get my FFE I just called her up. I told her what I wanted and she quoted me a great out the door price and had the color/options I wanted, so I said "let's do it". She told me to fill our their on line credit app (took about 2-3 min) and come pick it up that same day. When I got there the paperwork was ready, the car was prepped, and all I had to do was sign and drive off. Of course I wound up spending a bit longer, chit chatting, getting the tour of the car, etc.

I purchased mine (getting the $7500 tax credit and 0% financing was just too tempting), so I can't tell you what the lease deal would have been. I'm sure there are other sales people that are just as good to work with and the deals are probably very similar, but I'll certainly call Sherri at Walnut creek next time I'm in the market for a new Ford. The drive isn't that far and in my opinion adds to the fun.

Best of luck and let us know how it turns out.

BTW - several of us will be meeting Saturday morning for a drive up Mt Hamilton (see http://www.myfocuselectric.com/forum/viewtopic.php?f=14&t=2027). Feel free to come by and say high, and by all means if you get your car by then, join the fun.

blackbeasst

Well-known member

help me (and maybe others) understand something here.....

if a car has has an msrp of 36,990 and they show there is an instant savings of $6k to bring it down to 30,990, is that the price i'd be leasing at or are there other rebates/incentives/credits to bring it further down?

if a car has has an msrp of 36,990 and they show there is an instant savings of $6k to bring it down to 30,990, is that the price i'd be leasing at or are there other rebates/incentives/credits to bring it further down?

Kakkerlak

Well-known member

Electric vehicle pricing can be confusing because there are so many incentives coming from different places. I'm no expert but I'll try to share what I know.

There are three important incentives you need to understand.

1. Ford's incentive.

2. IRS Tax Credit.

3. State Incentive.

Ford puts a very large incentive on FFE's. That's the $6000 that Ford calls "Retail Bonus Customer Cash".

The Federal government also has an incentive for Zero-Emission Vehicle buyers. It's up to $7500 as a tax credit for next year's IRS taxes. If you owe more than $7500 in Federal taxes you can take the whole credit. If you owe less, you can't take it all. You don't get the money back until next year's tax return.

Some US States have a separate rebate or tax credit you can apply for when you buy a Zero-Emission Vehicle. The US Department of Energy has a really good website that describes these programs in detail: http://www.afdc.energy.gov/laws/

In Calfornia it's called the "Clean Vehicle Rebate Project" of the California Air Resources Board. You basically buy the vehicle then apply for a cash rebate from the State of California. Right now it's $2,500 but you have to wait until September to get the payment because of the way their budget works.

You mentioned you're in Georgia. From what I've read, Georgia has an income tax credit of 20% of the vehicle cost, up to $5000. Like the Federal tax credit, your ability to use that credit depends on how much income tax you owe.

In my State (Washington) we don't have an income tax, so our incentive is that ZEV's are exempt from Sales Tax.

How does this apply to you ?

36,900 MSRP

-6,000 Ford Retail Bonus Customer Cash

-7,500 Federal Tax Credit

-5,000 Georgia Income Tax Credit

+2,014 Georgia Ad Valorem Tax, 6.5% x $30,990

$20,504 Net Price

There are three important incentives you need to understand.

1. Ford's incentive.

2. IRS Tax Credit.

3. State Incentive.

Ford puts a very large incentive on FFE's. That's the $6000 that Ford calls "Retail Bonus Customer Cash".

The Federal government also has an incentive for Zero-Emission Vehicle buyers. It's up to $7500 as a tax credit for next year's IRS taxes. If you owe more than $7500 in Federal taxes you can take the whole credit. If you owe less, you can't take it all. You don't get the money back until next year's tax return.

Some US States have a separate rebate or tax credit you can apply for when you buy a Zero-Emission Vehicle. The US Department of Energy has a really good website that describes these programs in detail: http://www.afdc.energy.gov/laws/

In Calfornia it's called the "Clean Vehicle Rebate Project" of the California Air Resources Board. You basically buy the vehicle then apply for a cash rebate from the State of California. Right now it's $2,500 but you have to wait until September to get the payment because of the way their budget works.

You mentioned you're in Georgia. From what I've read, Georgia has an income tax credit of 20% of the vehicle cost, up to $5000. Like the Federal tax credit, your ability to use that credit depends on how much income tax you owe.

In my State (Washington) we don't have an income tax, so our incentive is that ZEV's are exempt from Sales Tax.

How does this apply to you ?

36,900 MSRP

-6,000 Ford Retail Bonus Customer Cash

-7,500 Federal Tax Credit

-5,000 Georgia Income Tax Credit

+2,014 Georgia Ad Valorem Tax, 6.5% x $30,990

$20,504 Net Price

Kakkerlak

Well-known member

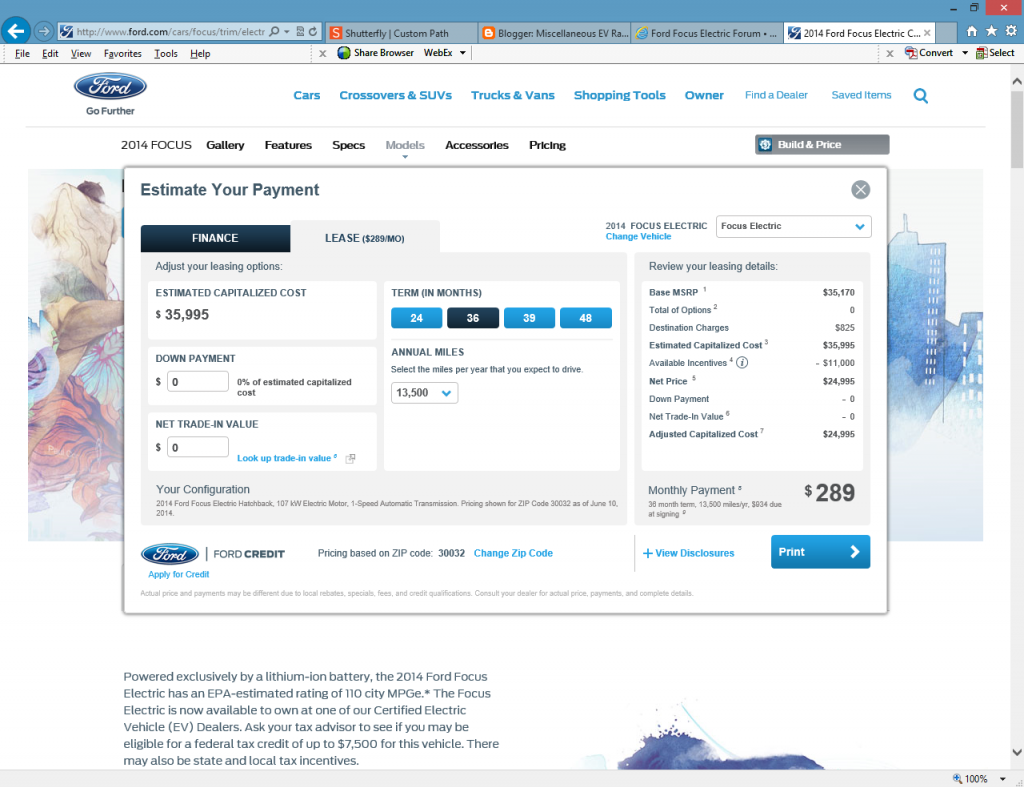

You might also see an $11,000 incentive being talked about on this Forum.

When you lease an FFE from Ford Motor Credit instead of buying it outright, Ford Motor Credit is the owner of the car, so they're the ones who get the $7500 Federal tax credit. So they pass that on to you, plus another $3,500 incentive.

One of the neat things about this Forum is that there have been examples where Members have shown their actual purchase and lease documents to explain how the taxes and incentives worked out for them.

You can find a thread from last year in which an FFE buyer in New Jersey learned that his dealer had charged all the previous FFE buyers sales tax, and he was the first one who pushed back hard enough to make them admit that ZEV's were exempt from Sales Tax in New Jersey. What happened to those previous buyers' money, nobody knows.

When you lease an FFE from Ford Motor Credit instead of buying it outright, Ford Motor Credit is the owner of the car, so they're the ones who get the $7500 Federal tax credit. So they pass that on to you, plus another $3,500 incentive.

One of the neat things about this Forum is that there have been examples where Members have shown their actual purchase and lease documents to explain how the taxes and incentives worked out for them.

You can find a thread from last year in which an FFE buyer in New Jersey learned that his dealer had charged all the previous FFE buyers sales tax, and he was the first one who pushed back hard enough to make them admit that ZEV's were exempt from Sales Tax in New Jersey. What happened to those previous buyers' money, nobody knows.

blackbeasst

Well-known member

Kakkerlak said:Electric vehicle pricing can be confusing because there are so many incentives coming from different places. I'm no expert but I'll try to share what I know.

There are three important incentives you need to understand.

1. Ford's incentive.

2. IRS Tax Credit.

3. State Incentive.

Ford puts a very large incentive on FFE's. That's the $6000 that Ford calls "Retail Bonus Customer Cash".

The Federal government also has an incentive for Zero-Emission Vehicle buyers. It's up to $7500 as a tax credit for next year's IRS taxes. If you owe more than $7500 in Federal taxes you can take the whole credit. If you owe less, you can't take it all. You don't get the money back until next year's tax return.

Some US States have a separate rebate or tax credit you can apply for when you buy a Zero-Emission Vehicle. The US Department of Energy has a really good website that describes these programs in detail: http://www.afdc.energy.gov/laws/

In Calfornia it's called the "Clean Vehicle Rebate Project" of the California Air Resources Board. You basically buy the vehicle then apply for a cash rebate from the State of California. Right now it's $2,500 but you have to wait until September to get the payment because of the way their budget works.

You mentioned you're in Georgia. From what I've read, Georgia has an income tax credit of 20% of the vehicle cost, up to $5000. Like the Federal tax credit, your ability to use that credit depends on how much income tax you owe.

In my State (Washington) we don't have an income tax, so our incentive is that ZEV's are exempt from Sales Tax.

How does this apply to you ?

36,900 MSRP

-6,000 Ford Retail Bonus Customer Cash

-7,500 Federal Tax Credit

-5,000 Georgia Income Tax Credit

+2,014 Georgia Ad Valorem Tax, 6.5% x $30,990

$20,504 Net Price

So say I can't take advantage of the full $7500 in my taxes, do I still get that off the top to bring the lease price down?

jmueller065

Well-known member

Yes: If you lease you get all of the $7500 tax break even if you don't owe that much in taxes (because the tax credit goes to Ford Credit which does owe more than $7500 in taxes LOL).

blackbeasst

Well-known member

Wow, good to know. Gotta learn all I can to arm myself before I go talk to them for the first time.

With me being in Georgia with all the tax breaks, what's the best number I should look for when leasing? Take into consideration that I don't want to put any money down and will be doing a 3 year 18k mile lease.

With me being in Georgia with all the tax breaks, what's the best number I should look for when leasing? Take into consideration that I don't want to put any money down and will be doing a 3 year 18k mile lease.

TexaCali

Well-known member

Kakkerlak said:How does this apply to you ?

36,900 MSRP

-6,000 Ford Retail Bonus Customer Cash

-7,500 Federal Tax Credit

-5,000 Georgia Income Tax Credit

+2,014 Georgia Ad Valorem Tax, 6.5% x $30,990

$20,504 Net Price

I can't speak for Georgia, but here in CA, the sales tax is applied BEFORE the $6,000 rebate from Ford. The state is very aggressive in insuring they get their sales tax money. Case in point, you go get a new cell phone, advertised as free with contract. Well, that phone was $500 without contract and CA wants their $50 in sales tax even if the phone was "free". Hopefully GA is better, but even if not, at least they give you a $5k credit vs $2.5K.

twscrap

Well-known member

You should be able to do a lot better in your area. The Ford Website is showing $11k in incentives for the Atlanta area.blackbeasst said:help me (and maybe others) understand something here.....

if a car has has an msrp of 36,990 and they show there is an instant savings of $6k to bring it down to 30,990, is that the price i'd be leasing at or are there other rebates/incentives/credits to bring it further down?

ElSupreme

Well-known member

twscrap said:The Ford Website is showing $11k in incentives for the Atlanta area.

That is for a leases. The purchase is $6k off sticker. The lease includes the $7.5k federal tax rebate so isn't quite as good at the purchase deal.

twscrap

Well-known member

ElSupreme said:twscrap said:The Ford Website is showing $11k in incentives for the Atlanta area.

That is for a leases. The purchase is $6k off sticker. The lease includes the $7.5k federal tax rebate so isn't quite as good at the purchase deal.

Assumed leasing was the desired option.blackbeasst said:So say I can't take advantage of the full $7500 in my taxes, do I still get that off the top to bring the lease price down?

blackbeasst

Well-known member

i think after reading around leasing is the preferred method for me. heading in after work to talk to them about it. i'll post up when i get home what kinda numbers they are throwing at me. was just trying to get all the rebates/incentives/credits totaled up just in case they leave any out.

but based on the math someone did earlier i should be around this ballpark:

36,900 MSRP

-6,000 Ford Retail Bonus Customer Cash

-7,500 Federal Tax Credit

-5,000 Georgia Income Tax Credit

+2,014 Georgia Ad Valorem Tax, 6.5% x $30,990

~$20,504 Net Price??? <------is that the price my monthly lease payment would be based off of?

but based on the math someone did earlier i should be around this ballpark:

36,900 MSRP

-6,000 Ford Retail Bonus Customer Cash

-7,500 Federal Tax Credit

-5,000 Georgia Income Tax Credit

+2,014 Georgia Ad Valorem Tax, 6.5% x $30,990

~$20,504 Net Price??? <------is that the price my monthly lease payment would be based off of?

Similar threads

- Replies

- 3

- Views

- 916

- Replies

- 4

- Views

- 2K

- Replies

- 4

- Views

- 1K